Big technology companies have always been known for generating price appreciation for investors, but the tide is slowly changing. Personal electronics giant Apple (NASDAQ: AAPL) has paid dividends since 2012. Meanwhile, Meta Platforms (NASDAQ: META) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) recently joined the dividend ranks.

Many dividend investors look for cash flow first and foremost. Did you know these three companies have combined for an astounding $220 billion in cash flow over the past year alone? No group of businesses has generated as much cash flow in humanity’s history as these technology giants.

Now, they’ve turned on the spigot, funneling some of those profits to shareholder profits.

Here’s the pitch for why each company is among the smartest dividend stocks you can buy for under $1,000.

1. Apple is still among the world’s best businesses

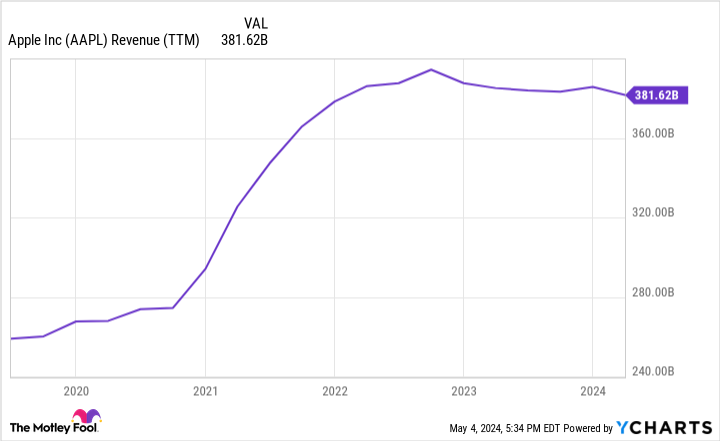

Things haven’t been perfect for Apple in recent years. The company’s growth has stagnated, a sign that Apple has gotten so big that its flagship iPhone product can no longer move the needle. But don’t get it mixed up; Apple is still a behemoth that earns more in cash flow than all but a few companies worldwide do in sales. It’s still Warren Buffett‘s top holding, even if the Oracle of Omaha sold some of his stock via Berkshire Hathaway.

Long-term investors should focus on some very important facts. First, Apple can return more cash to shareholders than any company. It recently unveiled the largest share repurchase program in U.S. history, a $110 billion buyback that will dent the company’s share count (and boost earnings per share). Additionally, the dividend has a multidecade runway for growth. The dividend payout ratio is just 15% of cash flow. Apple has all the makings of a future Dividend King, especially as those massive buybacks show how quickly the payout ratio rises as the dividend grows.

Most importantly, Apple is one big product away from newfound growth. More than two billion people have active iOS devices worldwide, and there are growing middle classes worldwide, including in India, where the company is shifting parts of its production. That’s a massive distribution network for new products. Plus, Apple still hasn’t swung hard at artificial intelligence (AI), so watch out. Apple’s best growth is probably behind it, but earnings per share could still have plenty of juice to squeeze.

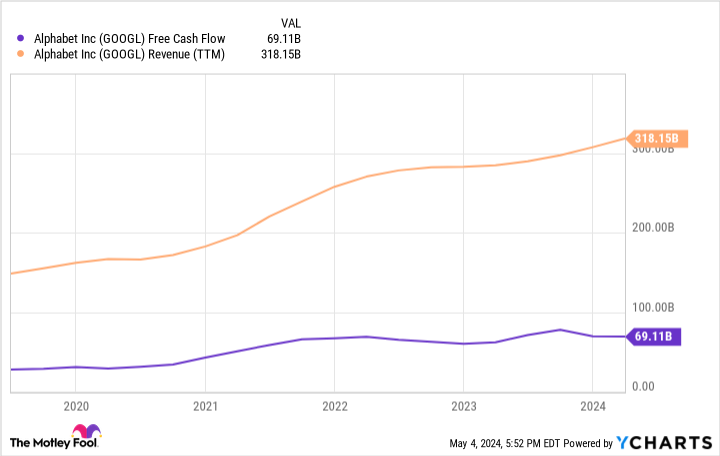

2. Alphabet is the newest member of the big-tech dividend club

Google’s parent company, Alphabet, recently unveiled its first dividend during its first-quarter earnings. The quarterly payout will add up to $0.80 annually for a starting 0.5% yield. That’s obviously not much, but Alphabet is one of the largest cash cows on Earth. Rest assured, that dividend will grow over the decades to come. Think of buying shares today as getting in on the dividend “ground floor.” It’s only going up from here. If that wasn’t enough, Alphabet casually tacked another $70 billion to its ongoing share repurchase program.

Alphabet makes most of its money by advertising on Google and YouTube, and while advertising can be sensitive to the economy, Alphabet hasn’t suffered a dramatic downturn in its business:

Google and YouTube are the two most-visited websites worldwide by a wide margin. Alphabet’s advertising revenue is still growing at a double-digit rate, which signals significant cash flow growth still ahead. That should be music to long-term investors’ ears. The dividend starts from a minuscule size, just 15% of annual cash flow, so look for a ton of growth over the coming years. Now is a great time to buy and watch your passive income grow.

3. Meta has the makings of a dividend powerhouse

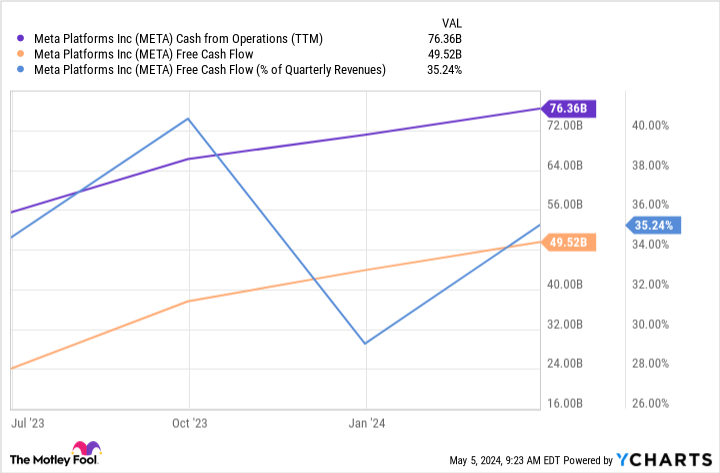

Wall Street can be short-sighted. Perhaps that’s why Meta’s stock has retreated from its highs after CEO Mark Zuckerberg made it clear in Q1 earnings that the company will continue investing heavily in artificial intelligence. But this is an opportunity for long-term investors to scoop up this future dividend superstar at a lower price. Meta’s lucrative advertising business involves selling ads on its social media apps: Facebook, Instagram, WhatsApp, and (eventually) Threads.

Remarkably, Meta is converting 35% of its revenue to free cash flow despite spending tens of billions of dollars in capital expenditures. Cut those in half, and Meta would convert a staggering 44% of sales to cash. Keep that in mind for the future when capital expenditures eventually recede.

Meta is also growing swiftly; revenue grew 27% year over year in Q1. The company potentially has years of double-digit growth ahead and decades of double-digit dividend increases. Don’t let the stock’s meager 0.1% yield turn you away. The payout ratio is only about 10% of free cash flow and even less of operating cash flow. Meta is a true compounder — a business that is growing earnings and the cash it returns to shareholders at a double-digit rate, a gem long-term investors should buy and hold indefinitely.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,959!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, Berkshire Hathaway, and Meta Platforms. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy With Under $1,000 Right Now was originally published by The Motley Fool

feed from Finance.yahoo.com