Ethereum price is surging, but some big whales are choosing to exit ETH USD ahead of higher prices. What’s going on?

Crypto prices are trending higher. After yesterday’s gains, the total crypto market cap is up nearly +0.5% to over $2.3 trillion.

Bitcoin

and Ethereum

remain the most valuable.

Ethereum Price is Rising: Bulls Targeting $2,800

While Bitcoin is in focus, expanding ETH prices to spot rates has been relieving for holders.

After days and weeks of steady lower lows, the bounce could be the initiative bar that lifts the coin to fresh highs.

As ETH bulls target $2,800, the July high, it appears that some whales are taking advantage of the possible FOMO to exit in a possible contrarian.

The latest on-chain data shows that whales have been moving coins to exchanges. Although it might be hard to determine whether they sold immediately, such transfers often signal the owner’s intention to sell.

Accordingly, analysts interpret all coin transfers to Binance, Kraken, OKX, or any centralized crypto exchange as bearish.

But… Ethereum Whales Are Cashing Out?

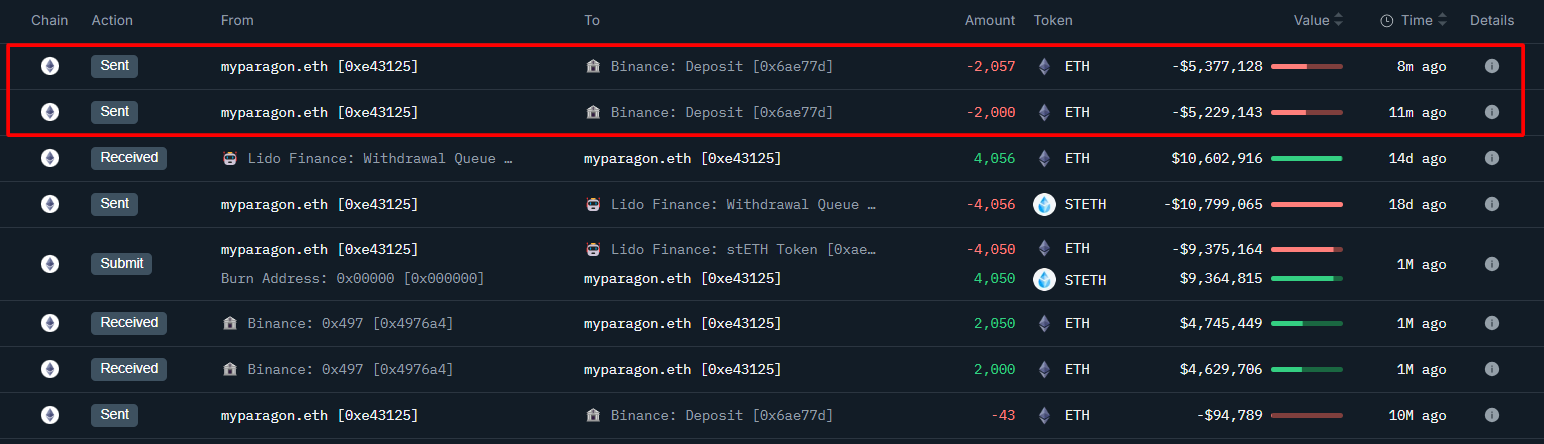

Earlier today, one whale, “myparagon.eth,” moved 4,056 ETH, worth approximately $10.6 million, into Binance.

The transfer follows the address’s decision to stake 4,050 ETH via Lido Finance before unstaking roughly three weeks ago. Out of this staking, the whale received 6 ETH as a yield.

(Source)

If the Ethereum whale sells at spot rates, the 4,056 ETH will yield a $1.23 million profit now that prices have steadily stabilized before rising yesterday.

The address is not the only one.

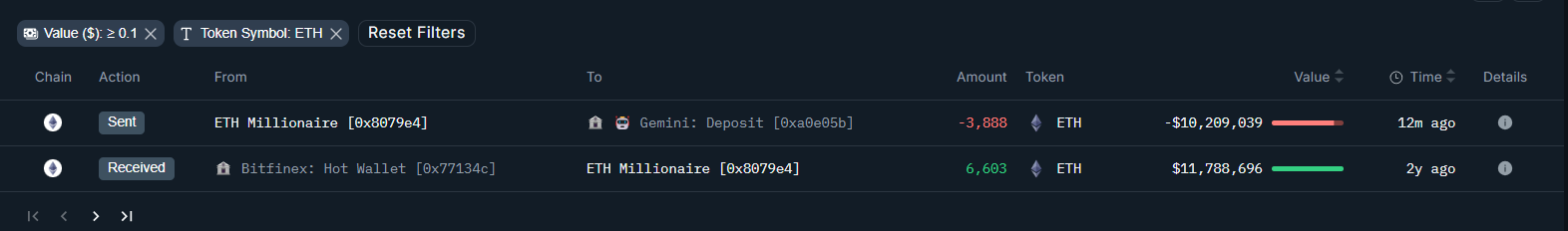

Another dormant whale deposited 3,888 ETH early today to Gemini. The stash, worth over $10 million, is part of the 6,603 ETH the address received from Bitfinex roughly 18 months ago.

(Source)

At that time, each coin was changing hands for $1,785. While the address moved 3,888 ETH to Gemini, it still holds 2,715 ETH worth over $7.1 million at spot rates.

It is likely that these whales will liquidate their stash for USDT or other coins.

Ethereum Price Analysis: Will Selling Whales Regret?

Still, it remains to be seen whether, if they sell, they will regret their decision.

Analysts are convinced the second most valuable coin is undervalued.

(ETHUSDT)

Looking at the daily chart, the local resistance is at $2,800. Ethereum might easily float above $3,000 if yesterday’s gains are confirmed.

However, should bulls press on and there is a convincing close above $3,500, it would mark a sharp change in trend, possibly creating a base for another moonshot to $4,100 in a buy trend continuation formation.

Ethereum Layer-2s Expanding

There are primers that may support ETH bulls going forward. Although fewer coins have been burned since after the activation of Dencun, builders are hard at work.

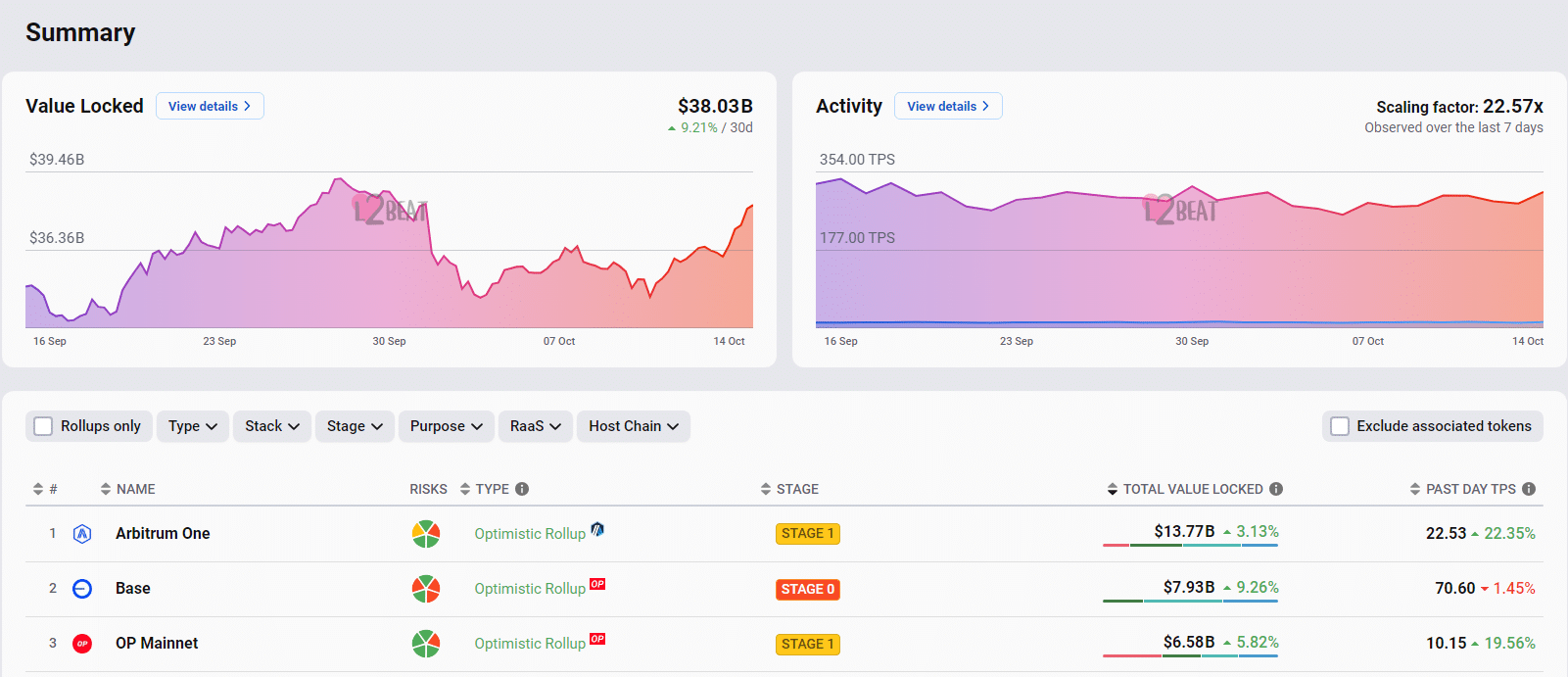

Layer-2s are especially booming and rapidly expanding. As of mid-October, all Ethereum layer-2s managed over $38 billion in assets.

(Source)

Additionally, more layer-2s are set to launch on Ethereum, including Pepe Unchained, a platform dedicated to meme coins, and Unichain by Uniswap, one of the world’s largest DEXes.

EXPLORE: What Does Kamala’s Unrealized Gains Tax Mean for Crypto Bags?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.