This week, the financial world and Bitcoin price are bracing for a cascade of critical economic reports, including the Federal Open Market Committee minutes (FOMC), alongside a high-stakes event within the cryptocurrency market.

From Federal Reserve deliberations to the expiration of billions in Bitcoin and Ethereum options, a perfect storm of factors could amplify volatility in the days ahead.

Federal Reserve FOMC Minutes Set the Tone for Risk Assets Like Bitcoin Price

Wednesday, November 27, marks the release of the Federal Reserve’s November meeting minutes—a date that holds Wall Street’s collective attention. Investors will comb through, looking for any shifts in strategy, like rethinking the 2% inflation benchmark or easing up on rates. Any lean toward monetary loosening could jolt risk assets to life, and crypto won’t miss the party.

“The Fed’s policy direction in these uncertain times could determine the trajectory of global financial markets,” said financial analyst Mark Brown.

This week will have very low trading volumes due to holidays.

Massive buy backs continue regardless.

Unless Tue FOMC minutes were written by a bipolar FED staffer…

We have a beautiful set up this week.

📈🚀❤️— Felix Prehn 🐶 (@financefelix) November 25, 2024

Inflation takes center stage on Wednesday, November 27, as the PCE price index—the Fed’s go-to metric—will drop for investors to view. Most forecasts put it at a modest 0.2% month-over-month and 2.3% year-over-year.

Stripping out food and energy, core PCE inflation could hit 2.8%, hinting at mounting economic strain. Adding weight to the day, Q3 2024 GDP revisions are set to give a sharper read on economic performance.

Also on the calendar is the revision of U.S. GDP figures for Q3 2024, which will provide a fresh lens into the nation’s economic health. No matter how the data lands—above or below projections—its shockwaves will ripple through the markets, shaking up everything from blue chips to meme coins.

DON’T MISS: Best New Cryptocurrencies to Invest in 2024

Traders Prepare for Volatility with $10 Billion in Bitcoin and Ethereum Options Expiring

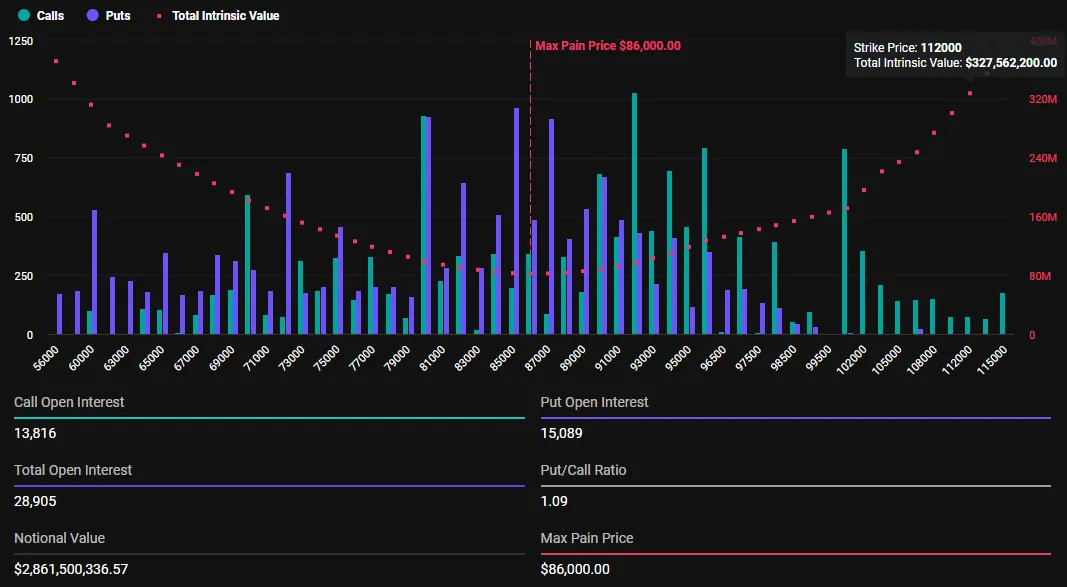

Another layer of tension is that on November 29, $10 billion worth of crypto options hit their expiration dates, creating an electric charge in the market. Bitcoin leads the action, with $9.1 billion tied up and a put/call ratio of 0.80, while Ethereum’s $1.24 billion wagers reflect a 0.77 ratio.

The max pain levels—$77,000 for Bitcoin and $2,800 for Ethereum—are a battleground of diverging predictions, setting traders on edge.

Mega options expirations like these often spawn short-lived market chaos as traders scramble to reposition. “Pullbacks may come,” veteran trader Peter Brandt remarked, “but the long-term bull run for crypto stands firm.”

Crypto Faces a Crucial Intersection

The question remains whether cryptocurrencies will weather this dual challenge with resilience or see intensified volatility that tests investor confidence. For now, all eyes are on this action-packed week that could redefine short-term narratives across both traditional and digital financial landscapes.

Whether you’re a crypto enthusiast or an economic observer, this week promises to deliver key insights—and the potential for dramatic market shifts. Buckle up because volatility is knocking at the door.

EXPLORE: 20 New Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

We hate spam as much as you do. You can unsubscribe with one click.